Smart resources to keep you ahead of the 'game'

We work with many investment advisors, investment counsels and portfolio managers to help them adjust and refine their processes as required in today’s fast pace environment.

Through our consultative approach, we spot opportunities for improvement and add needed layers of fundamental or technical financial modeling to existing forecasting and portfolio building methodologies.

The important thing to understand is this: we do not mean to change your process, instead, our job is only making it more precise and more efficient. We do not tell people how they should run their business or what their mandates should look like, rather we listen to what you are trying to achieve for your clients and commit the resources you need to get to your destination with minimum effort.

Nothing that is incompatible with your objectives, set of constraints or even your overall comfort zone works for us. All we will be doing for you is apply our capital markets know-how and deploy our trading technology so you can comfortably achieve whatever you are trying to achieve in any market environment.

We apply several key principles in the consulting work we do for asset managers:

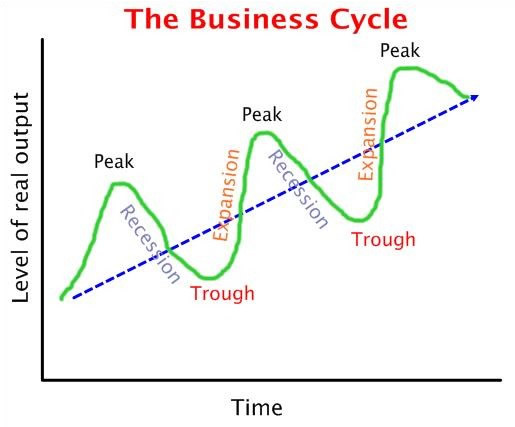

Shape of the business cycle

The path of economic development is generally upwards at the largest degree of trend. Yet, the movement is non-linear in nature. It is well known that phases of economic contraction and economic expansion succeed one another and economic output can move in either direction over the short-to-medium term – of course in the context of an overall output uptrend (higher highs and higher lows) over longer time horizons.

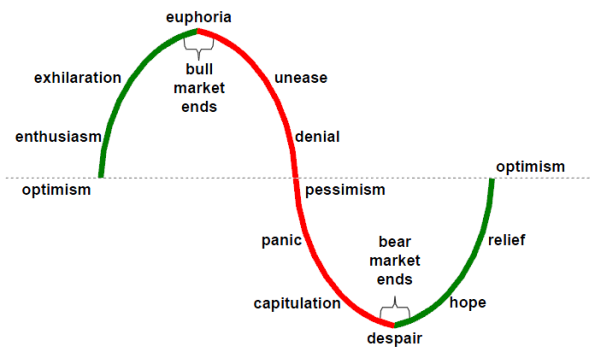

Collective emotion follows a certain progression in a full market cycle

Asset prices are the result of aggregate supply and demand which in turn is more a function of mass psychology than anything else. People do not feel hopeful, optimistic, confident or euphoric just like that, by themselves; they always do so in an overall social context that impacts them and that they impact in return. By the same token, people do not feel hopeless or pessimistic nor do they despair or panic in isolation but rather because other people in their social universe feel the same way or do the same things. The fact that the cycle of mass human emotion and collective mood follows a specific sequence and pattern is something of unusual importance in the field of investments.

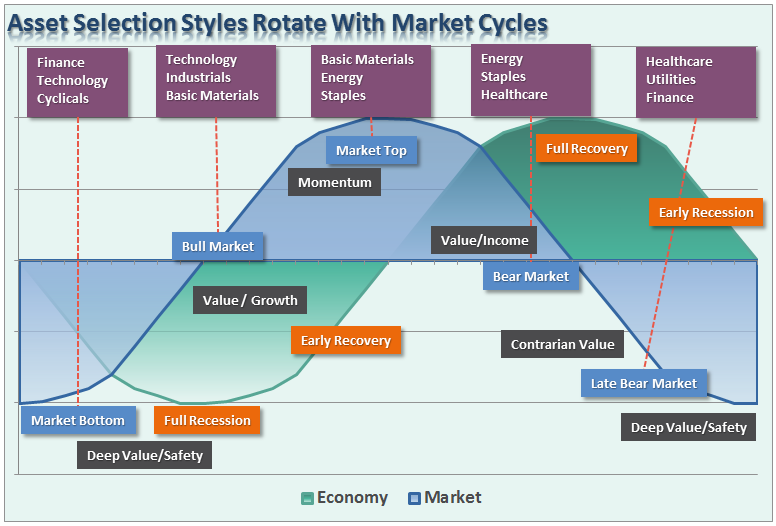

Market sectors and styles rotate with the market and economic cycle.

The correlation patterns between asset classes result from natural cyclical or counter-cyclical relationships. They impact the way liquidity is available in the financial system and the economy and also the way that liquidity is being absorbed. In addition, we must not underestimate the impact a confident or fearful collective investment mind has in deciding sector or style investment preferences. All these things impact the performance of sectors and styles to various degrees in such a way that there actually is a pattern of sector and style rotation at different points in the market and economic cycle.